Description

❓ Ever wondered how the #WaterIndustry was reacting to our World's Water Challenges? Water Scarcity? #SDG6? PFAS? Climate Change? Circular Economy? Digitization and Smart Water?

💪 Get the Water Market pulse for free. In one hour per week, while you do the dishes!

📈 We talk water investment, water tech, water entrepreneurship and water market with entrepreneurs, thought leaders, book authors, scientists, investment funds, VCs, and C-Level experts from water majors.

➡️ Leverage their insights, advice & experience and ensure to stay on top of best practices

🗓️ Tune in every Wednesday (don't miss out! 😅)

🌐 Find all the detailed episode notes, interviews, infographics, and more at http://dww.show

Currently in its 10th Season, the "(don't) Waste Water" podcast has already welcomed around 250 guests from Water Majors (SUEZ, Veolia, Jacobs, Xylem, Kemira, Evoqua, Aquatech, SKion Water...), Scale-Ups (Cambrian Innovation, Epic Cleantec, Gradiant, Liqtech, 374Water, Gingko Bioworks...), Start-Ups (Puraffinity, KETOS, 120Water, ZwitterCo, Membrion, Source...), Universities (Berkeley, the Columbia Water Center), Investment Funds (Sciens Water, Mazarine, Burnt Island Ventures...), Business Accelerators (Imagine H2O, Elemental...), Book Authors (Seth Siegel, David Sedlak, David Lloyd Owen...) or Market Intelligence Companies (BlueTech Research, Global Water Intelligence, World Bank, OECD, Isle Utilities...). Or simply water legends like Gary White, Mina Guli or Andrew Benedek!

On the "(don't) Waste Water" podcast, I strive to make the Water Industry easy to understand for everyone, starting with water professionals, executives, and investors. Hence, he opens the microphone to seasoned, inspirational water experts to discuss their field of excellence.

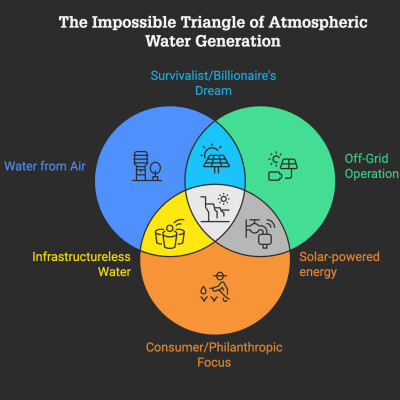

No one can claim an all-around in-depth understanding of a matter as complex as Water. But piece by piece, you can rebuild the puzzle. With curiosity, patience, and passion, Antoine Walter explores topics such as Advanced Treatment Technologies, Water-Energy Nexus (Hydrogen, Lithium...), PFAS removal, Nature-Based Solutions, Wastewater Reuse, Distributed Water Treatments, Water Finance, and Water Entrepreneurship.

I actually firmly believe that regular listeners of the "(don't) Waste Water" podcast may, in the end, claim a "Water MBA!"

A particular field of interest is how innovation forms, grows and gets widely adopted in a complex and conservative field like the Water Industry. This may be one of the keys to achieving the United Nations Sustainable Development Goal n°6 - #SDG6.

Oh, and in short, about me: I'm a water engineer turned avid student of the water business, market, finance, and tech. I'm married, a happy father of three, and I'm French (nobody's perfect 😅).

Hosted on Ausha. See ausha.co/privacy-policy for more information.

![25 Years of Acquisitions Built This Water Tech Powerhouse [M&A] cover](https://image.ausha.co/6xHgWghhG8OqgQaZ4Jpi3EzqoqcC8w1w1vWw6qNl_400x400.jpeg)